What’s going on in the housing market?

Many buyers are wondering whether they’re overpaying as home prices remain elevated across Orange County and Newport Beach. But according to the latest housing data, the fundamentals still favor sellers — and there’s a unique window of opportunity for motivated buyers right now.

Mortgage rates have fallen below 6.5%, the lowest level in over a year. This drop has reignited buyer activity and improved affordability, even as inventory remains historically tight. Homes that are priced well continue to attract strong offers, and supply simply isn’t keeping up with current buyer demand.

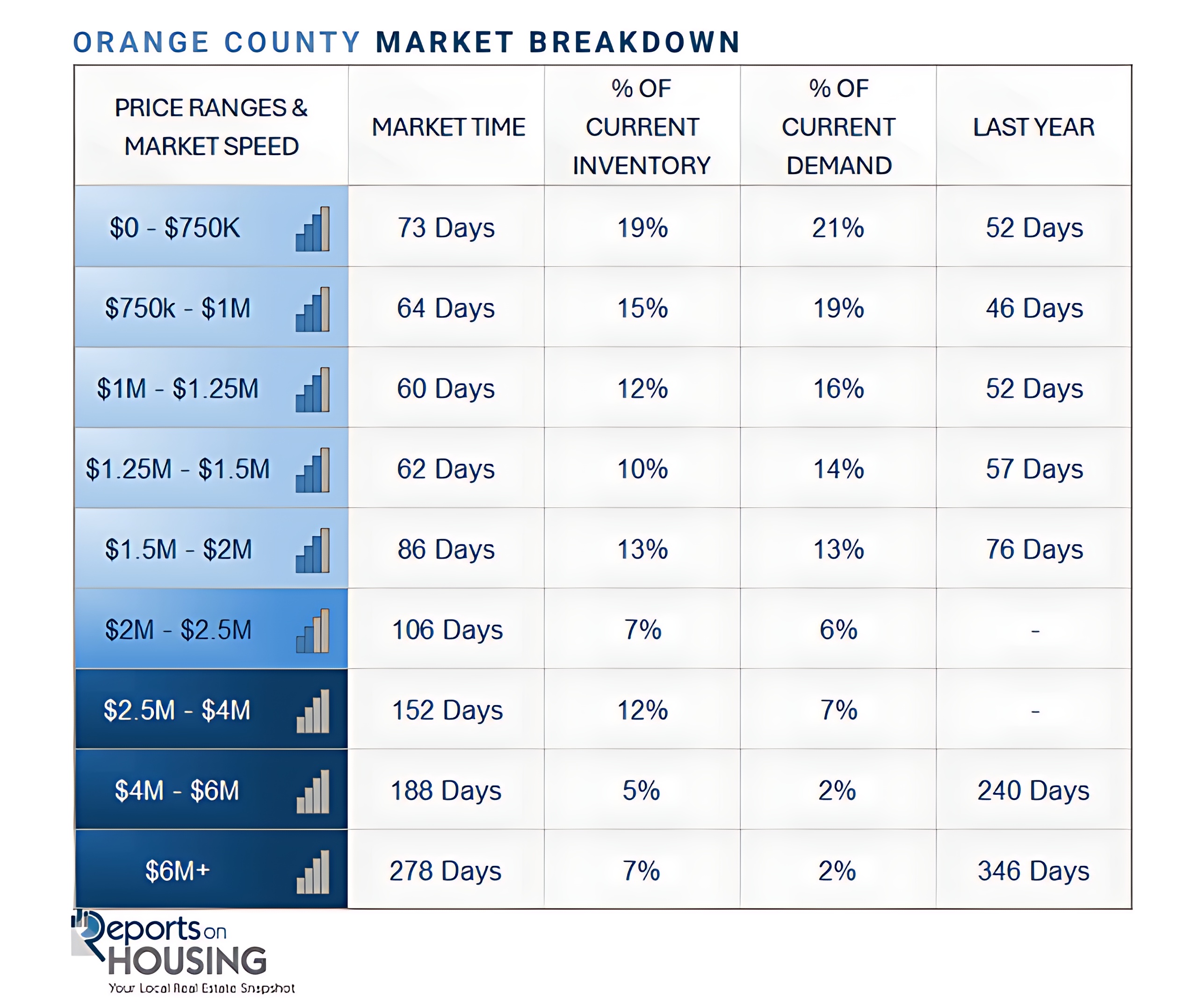

Orange County Market

Many buyers wonder if they’ve missed their chance as home prices remain elevated — but according to the latest Orange County Housing Report, the real opportunity is happening right now.

Mortgage rates have dropped below 6.5%, their lowest level in over a year, sparking improved affordability and renewed buyer confidence. At the same time, housing supply is up significantly compared to last year, giving buyers more room to negotiate. These conditions — lower rates, higher inventory, and softer seller expectations — rarely align at once, creating a true window of opportunity before the market accelerates into 2026.

Historically, whenever rates dip and supply expands, demand quickly follows. Last year’s brief rate drop below 6.5% ignited a 13% jump in pending sales. Now, with rates expected to remain near these lows for months, we’re seeing the early signs of another rise in buyer activity — and this time, it’s likely to last longer.

ACTIVE INVENTORY

The active listing inventory dropped by 190 homes in the last two weeks, down 4%, to 4,288 total homes — the largest decline of the year and the lowest level since April. Yet even with this drop, inventory remains 18% higher than last year’s 3,640 homes and 78% higher than in 2023, providing more opportunities for buyers. Many long-listed homes are now seeing price adjustments, and sellers are increasingly open to negotiation. As we approach the holidays, the number of new listings will continue to slow, setting the stage for tighter supply heading into spring.

Demand

Demand, measured by new pending sales, declined slightly by 2% over the past couple of weeks, now at 1,546 pending transactions. Despite this minor dip, buyer activity is outperforming expectations for the fall season. Lower mortgage rates are keeping demand elevated compared to the same period last year, and economists anticipate a notable rebound in early 2026 as buyers re-enter the market. Detached homes are currently selling faster than attached, with an Expected Market Time of 83 days, the quickest pace since April.

Newport Beach – Single-Family Homes

The single-family home market in Newport Beach continues to show signs of stability, with activity remaining steady and favoring sellers in most price segments. The median list price stands at $5,895,000, while the Market Action Index holds at 33, reflecting a slight seller’s advantage as demand keeps pace with limited supply.

Inventory remains consistent at 177 active listings, and homes are spending a median of 98 days on market, suggesting that buyers are active but selective. About 28% of listings have experienced price adjustments, a sign that sellers are aligning expectations with market realities to stay competitive. Pricing has largely plateaued, with the average price per square foot at $1,717, indicating a balanced environment as 2025 winds down.

Overall, the market continues to demonstrate strength, with well-presented, accurately priced homes moving steadily despite seasonal cooling.

The Market Action Index for single-family homes in Newport Beach remains in seller territory, signaling steady buyer activity.

Newport Beach – Condos & Townhomes

The condo and townhome market in Newport Beach is displaying similar stability, maintaining a balanced yet seller-leaning position as the year comes to a close. The median list price is $2,335,000, with a Market Action Index of 40, reflecting steady buyer demand and a market that remains favorable to sellers overall.

Inventory has eased slightly to 56 active listings, while the median days on market sits at 60, showing that well-priced properties continue to move efficiently. Approximately 38% of listings have seen price adjustments, signaling that sellers are responding to shifting buyer expectations in an evolving interest rate environment.

The average price per square foot holds at $1,280, underscoring a market where pricing and demand have found equilibrium. With prices plateauing across most segments, Newport Beach’s condo and townhome sector continues to offer resilience and stability in the face of broader market moderation.

The Market Action Index for condos and townhomes remains strong, reflecting steady buyer demand in a balanced market.